Navigating Your Year-End Financial Review

As 2023 comes to a close, now is a good time to engage in some financial housekeeping to ensure you are well-prepared for the opportunities that 2024 may bring. This is a busy season for everyone, but putting yourself first by making time for a year-end annual planning meeting is so important to maintain your financial well-being. In this blog post, we’ll guide you through key financial areas to review, helping you close out the year with confidence and set the stage for a prosperous 2024.

1. Prepare for Tax Season:

One of the most crucial aspects of year-end financial planning is developing effective year-end tax strategies. Take the time to explore potential deductions, credits, or tax-saving opportunities. Ensure that all relevant tax documents are prepared and filed on time. A proactive approach to tax planning can make a significant difference in your financial outlook for the upcoming year.

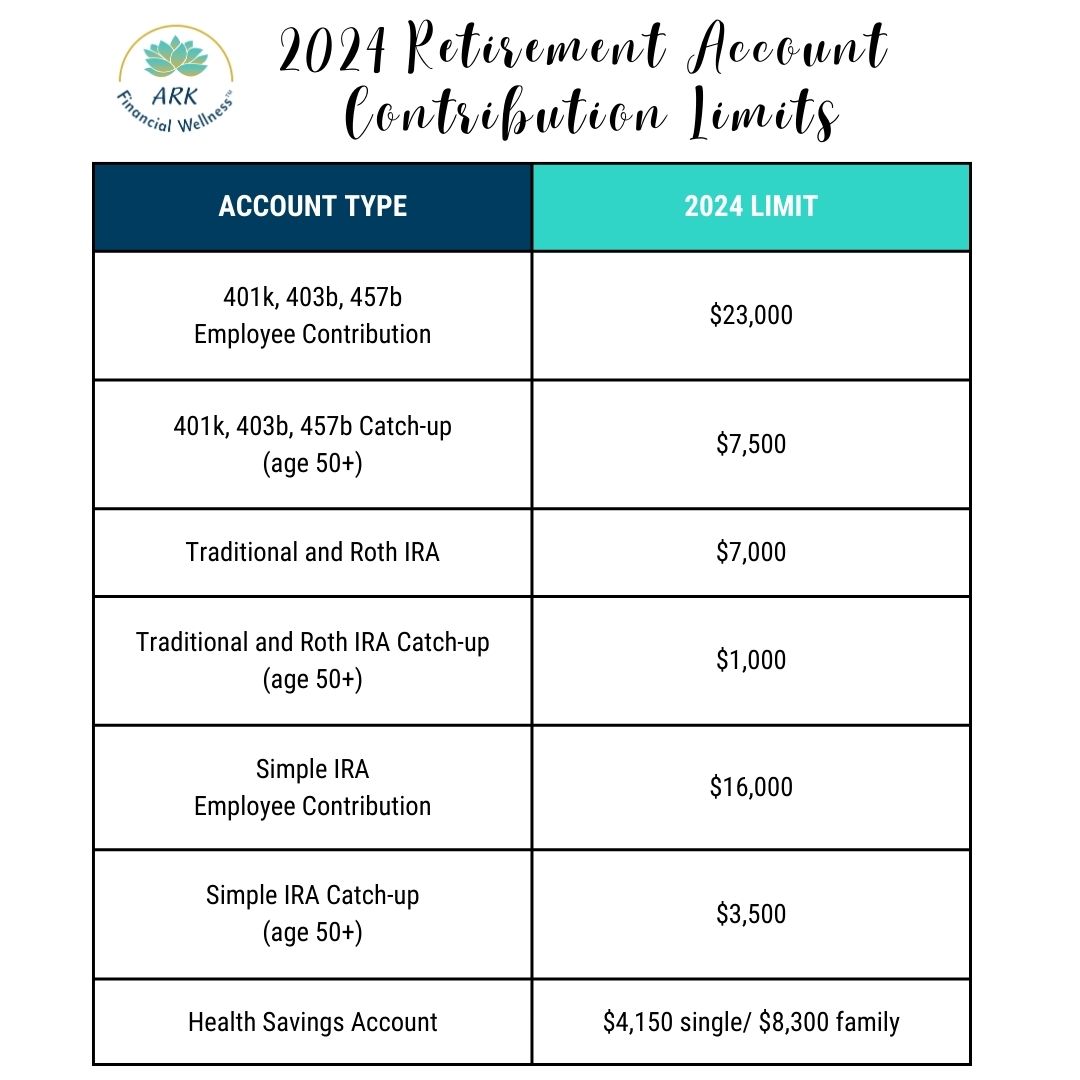

2. Maximize Retirement Contributions:

Be aware that the contribution limits for retirement accounts are increasing for 2024. If you have a direct deposit or payroll deduction set up so that you hit your systematic contribution goals by year-end, you may want to consider increasing that automatic deposit. In 2024, the contribution limits for 401(k) retirement plans will increase to $23,000, up from $22,500 this year. That extra $500 might not seem like a lot of money at first, but overtime that money can grow substantially. Intentionally contributing to your retirement accounts not only enhances your financial security in the long term but also provides immediate tax benefits for pre-tax retirement accounts.

3. Tax-Loss Harvesting:

Realizing a loss in the sale of an investment isn’t all bad! If you’ve incurred losses in your investments, this little strategy known as “tax-loss harvesting” may be extremely valuable. You may use the amount of the loss (up to certain limitations) to help reduce your tax liability in the year of the sale. Tax-loss harvesting also allows you to sell underperforming investments to offset capital gains realized in other investments which can effectively reduce your tax liability. This approach means that your money stays invested and continues making you money.

4. Define your cash flow and financial goals:

Knowing where your money is coming from and going to, or defining your cash flow, is the foundation of any solid financial plan. Review your 2023 spending and savings habits and determine if there is any room for improvement to set your 2024 financial goals. Pro Tip: In reviewing your expenses, reduce or eliminate those that do not align with your values or what you enjoy doing. If you see one (or many) expenses for things that you no longer even remember you have (subscriptions, for example), it’s time to make that money work better for you! Establishing a detailed plan for each paycheck will help you stay on track to hitting your short-term and long-term goals.

5. Beneficiary Review:

This last one is not so fun, but completely necessary. Whether or not it coincides with a major life change, it’s a good habit to review your beneficiaries on all financial accounts (investment, retirement, bank) and assets (cars, home, personal property) at least annually for accuracy. This is a critical step to ensure that your assets are distributed according to your wishes. Confirm the accuracy of listed beneficiaries and consider selecting contingent beneficiaries for added security. Additionally, address concerns about the potential tax burden and financial responsibilities that may be left to your beneficiaries with a lump sum distribution.

As we approach the end of 2023, it’s important to conduct a thorough year-end financial review. By preparing for tax season, maximizing retirement contributions, exploring tax-loss harvesting, setting a cash flow plan, and reviewing beneficiaries, you position yourself for financial success in 2024. Remember, we are here to assist you in getting organized and navigating these financial considerations with confidence and ease. Here’s to a prosperous and financially sound 2024!

Conclusion

Maximizing your money requires discipline and a commitment to your financial goals. Remember, the key to maximizing your money is to be intentional with your spending and to make your money work for you. Keep in mind that achieving your financial goals takes time and effort, but with the right mindset and habits, you can achieve the life you want.

Disclaimer:

This work is powered by Advisor I/O under the Terms of Service and may be a derivative of the original.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation.

This content not reviewed by FINRA

ARK Financial Wellness, LLC is an independent firm with advisory services offered through Blackridge Asset Management, LLC, a Registered Investment Adviser. Blackridge Asset Management is an SEC Registered Investment Advisory Firm.

ARK’s YouTube Videos

SECURE Act 2.0 Highlights

What is the SECURE Act? Lisa shares a brief summary of what it is, what the original bill included and how the changes in the SECURE Act 2.0 can help you save for a more successful retirement.

Click here to check out our blog post on this topic.

How to Start Out on the Right Foot in 2023

Lisa shares some questions to ask yourself and your loved ones which will help you to grow financially and personally in the new year.

What is a Fiduciary?

Lisa talks about what a fiduciary is and why its so important to work with someone who is held to a fiduciary standard when it comes to managing your money.

Read more about our Fiduciary Commitment here.

The Financial Future is Female

Traditionally, men have handled the finances. But at ARK, we are finding that more and more women, regardless of their relationship status- Single, married, divorced, widowed – are making the big financial decisions and are managing the day-to-day finances. Watch this video to learn more about the unique challenges and the many opportunities that women have when it comes to our finances. Check out the blog post on this topic also.

Planning for Your Future…and for Your Today

We find that clients sometimes struggle with doing what is needed to save for their future needs and goals, but also having enough leftover to live for today. Watch this video to find out what it means to live for today.

How Much Should I be Saving and Spending at Age 40?

“Where should I be – financially – at age 40?” Or any age for that matter? We get this question a lot at client meetings. While Google and benchmarks can help you get started, they can’t give you the answers you need for your particular situation, lifestyle and goals. Watch more to get tips on how to save and spend your money wisely at any age!

Real vs Fake Financial Advisors

Set the bar high, and do your homework in seeking a Financial Advisor to aid in making crucial financial decisions for you and your family. Get a good understanding of their background, education, experience and services by using free online tools to help you differentiate real from fake Financial Planners/Advisors!

If you have more questions about this, visit our FAQs page.